The most crucial thing you can do to manage your finances is to create a budget, yet a lot of individuals are hesitant to take this wise action. You might think of budgeting as including limitations, a lot of work, and difficulties.

You can perhaps think that your income is insufficient to support a budget.

However, creating a budget is important since it may help you avoid overspending, save money instead, and maximize each dollar.

Offers Financial Control

Every purchase must be documented, which keeps you accountable. It seals up the budget gaps when money seeps out since you weren’t paying close attention to it.

Do you buy a dollar’s worth of coffee every day? even five? Do you simply take cash out of your pocket or handbag without making any sort of accounting for it?

It’s so simple to withdraw $50 from the ATM and immediately spend it.

There is no responsibility, so you may spend it as you want without anybody knowing until the end of the month.

But, of course, there may be cases when it is very difficult to do without a cash loan wired in 1 hour, and you have to use it. Maintaining a budget forces you to keep track of every dollar you spend, which is a strong motivator to be trustworthy.

It Enables You to Maintain Your Focus

A budget enables you to identify and work toward your long-term objectives. How can you ever save enough money to purchase a vehicle or make a down payment on a house if you just drift aimlessly through life, throwing your money at any attractive, sparkly item that seems to catch your eye?

With the help of a budget, you are compelled to set objectives, save money, monitor your expenditures, and realize your aspirations.

Okay, so it could hurt to learn that your budget does not allow you the brand-new Xbox game or the exquisite cashmere sweater you saw in the store window.

However, it will be a lot simpler to do a U-turn and leave the store without purchasing anything if you remind yourself that you are setting money up for a new home.

You Can Find Financial Contentment

One of the fundamental components of sound financial conduct is financial happiness. It helps you enjoy your financial journey by preventing you from spending money that you don’t have.

But here’s the thing: you will never be satisfied if you spend all of your time worrying about other people’s finances.

This is known as “keeping up with the Joneses,” and it’s a horrible (and financially risky) way to live.

Instead, you should concentrate on making your own decisions and living your own life. And for that reason, having a budget is crucial. Interestingly, budgeting is characteristic not only of ordinary citizens but also of entire countries.

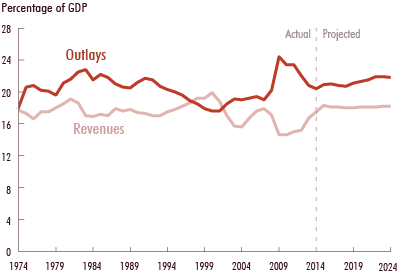

The public would own a rising quantity of government debt as a result of the ongoing and expanding deficits that the CBO anticipates.

According to the CBO’s baseline predictions, this debt will increase from 74% of GDP this year to 77% of GDP in 2024.

Every time you sit down to develop, evaluate, revise, or record costs into your budget, you are consciously choosing to put your finances ahead of those of others.

The use of other people’s money will eventually lose all of your attention. You will then know what it’s like to be financially content at that specific time.

This Aids in Trash Detection

If you’ve never kept track of your spending or set up a budget, you might be shocked by how much cash you probably throw away every month.

For instance, perhaps you often pause to have a coffee on your way to work, not realizing that this practice might easily increase your monthly spending by $100. This comes to $1200 yearly.

What might you accomplish with $1200 extra annually? It would amount to $6000 in five years. That’s enough for a luxurious trip or a down payment on a house.

After keeping track of your spending, you’ll be able to spot expenditure that isn’t in line with your financial objectives and divert it to help you achieve objectives that are important to you and your family.

It Makes Certain That You Don’t Spend Money You Don’t Have

Consumers spend far too much money that they don’t have. Before the advent of plastic, most individuals had a good sense of their financial situation.

They were on the right road if they had enough money at the end of the month to cover their expenses and put some money away for savings.

People who misuse their credit cards often don’t become aware of their spending habits until they are in serious debt.

You won’t ever be in this perilous situation if you set up and follow a budget. You’ll be fully aware of your income, your monthly spending capacity, and your required savings.

Yes, doing the math and managing a budget isn’t nearly as enjoyable as going on an unrestrained buying binge.

Consider it this way, though: at the same time that your spendthrift pals are scheduling a debt counseling session for this time next year, you’ll be flying off on that European vacation you’ve been saving for, or, even better, you’ll be moving into your new house.

Conclusion

You may greatly help yourself with your long-term financial planning by creating a realistic budget to predict your expenditure for the year.

So that you may plan for long-term financial objectives like establishing your own business, purchasing an investment or recreational property, or retiring, you can make reasonable estimates about your yearly income and expenses.